Safeguard Your Home and Liked Ones With Affordable Home Insurance Coverage Plans

Importance of Affordable Home Insurance

Safeguarding affordable home insurance is crucial for guarding one's property and economic health. Home insurance policy supplies security against different risks such as fire, burglary, all-natural calamities, and personal liability. By having a comprehensive insurance policy strategy in position, homeowners can feel confident that their most considerable investment is secured in the occasion of unexpected circumstances.

Economical home insurance not just offers economic safety but likewise offers assurance (San Diego Home Insurance). When faced with climbing residential property values and building costs, having an economical insurance plan ensures that house owners can conveniently rebuild or fix their homes without facing considerable economic burdens

Additionally, affordable home insurance coverage can additionally cover personal possessions within the home, using repayment for items damaged or taken. This insurance coverage extends beyond the physical structure of the residence, protecting the contents that make a home a home.

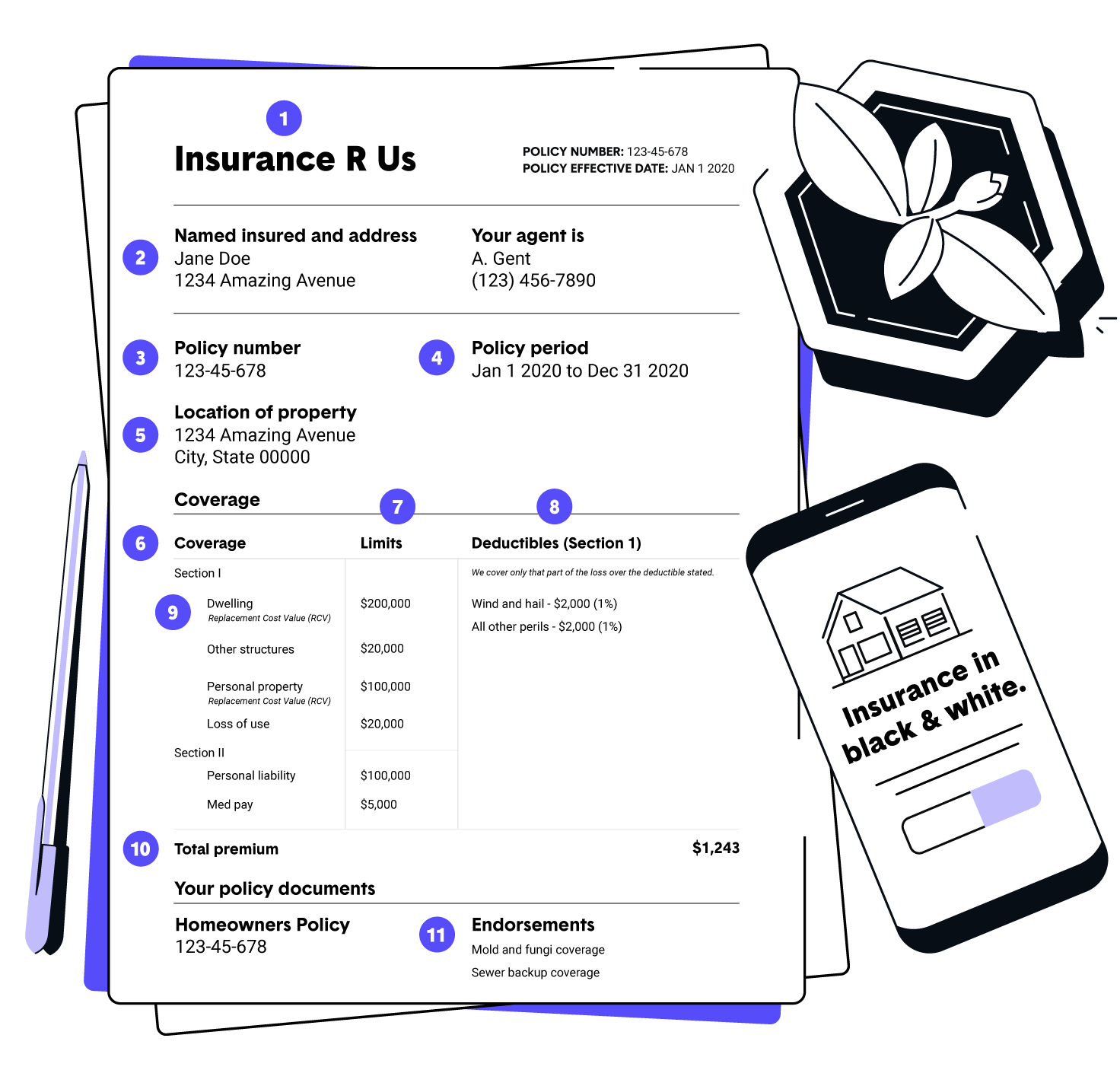

Protection Options and Purviews

When it pertains to protection restrictions, it's critical to understand the maximum amount your policy will pay out for each sort of coverage. These limits can vary depending on the policy and insurance provider, so it's necessary to examine them meticulously to guarantee you have adequate protection for your home and properties. By recognizing the insurance coverage alternatives and restrictions of your home insurance coverage, you can make educated choices to secure your home and liked ones properly.

Variables Influencing Insurance Policy Prices

A number of variables substantially influence the costs of home insurance plan. The place of your home plays a crucial duty in figuring out the insurance coverage premium. Residences in areas prone to all-natural catastrophes or with high crime prices normally have higher insurance policy expenses because of boosted risks. The age and condition of your home are likewise elements that insurance companies think about. Older homes or properties in inadequate condition might be extra costly to insure as they are a lot more prone to damage.

Furthermore, the type of protection you find more info select straight influences the price of your insurance coverage plan. Opting for additional coverage options such as flood insurance or earthquake coverage will enhance your premium.

Additionally, your credit rating, asserts background, and the insurance provider you select can all affect the cost of your home insurance policy. By considering these factors, you can make informed choices to aid handle your insurance coverage costs efficiently.

Comparing Quotes and Companies

In addition to comparing quotes, it is important to assess the track record and monetary security of the insurance coverage suppliers. Try to find client testimonials, rankings from independent firms, and any kind of background of problems or regulative actions. A trusted insurance policy provider should have an excellent record of without delay refining insurance claims and supplying exceptional like it customer care.

Furthermore, take into consideration the certain protection features used by each company. Some insurance companies may supply extra benefits such as identification theft security, equipment failure protection, or insurance coverage for high-value products. By carefully comparing quotes and service providers, you can make a notified choice and choose the home insurance policy plan that ideal satisfies your demands.

Tips for Reducing Home Insurance

After extensively comparing service providers and quotes to locate the most appropriate coverage for your requirements and spending plan, it is sensible to explore his response effective techniques for saving money on home insurance. One of the most substantial ways to save on home insurance is by bundling your policies. Numerous insurer offer discount rates if you buy multiple policies from them, such as integrating your home and vehicle insurance. Boosting your home's protection measures can also result in cost savings. Setting up protection systems, smoke alarm, deadbolts, or a lawn sprinkler can reduce the risk of damage or theft, potentially lowering your insurance premiums. Additionally, preserving a great credit rating score can positively impact your home insurance rates. Insurance providers commonly think about credit rating when establishing costs, so paying expenses in a timely manner and handling your credit responsibly can cause reduced insurance coverage expenses. Frequently evaluating and updating your plan to mirror any type of changes in your home or conditions can guarantee you are not paying for coverage you no longer demand, assisting you save cash on your home insurance coverage premiums.

Final Thought

In conclusion, securing your home and liked ones with cost effective home insurance coverage is vital. Carrying out ideas for conserving on home insurance can also help you safeguard the essential protection for your home without damaging the financial institution.

By unwinding the ins and outs of home insurance coverage plans and discovering practical approaches for protecting budget-friendly protection, you can guarantee that your home and liked ones are well-protected.

Home insurance plans normally use a number of coverage choices to safeguard your home and valuables - San Diego Home Insurance. By comprehending the insurance coverage choices and limits of your home insurance coverage policy, you can make enlightened decisions to guard your home and loved ones properly

On a regular basis evaluating and upgrading your policy to mirror any adjustments in your home or situations can guarantee you are not paying for coverage you no longer demand, helping you conserve cash on your home insurance policy premiums.

In verdict, protecting your home and enjoyed ones with inexpensive home insurance is crucial.